Barter economics is the theory that before there was money, there was trade, and that trade was done exclusively in goods and services for more goods and services. If a craftsman wanted food, or assistance building their home, they could trade a tool with a farmer for it, and vice versa. In this time before money, the dominant way to get what you want was to trade opportunistically using the products you have for the products you want, and the value of things could be decided in the moment in the purest example of supply meeting demand.

It sounds logical, but we know now that this perception of barter economics is largely – but not entirely – a myth. In fact, as far as we can currently tell, there may have been no point in recorded history where barter economics of this sort was the basis or expectation of everyday life – either internationally or locally. While barter economics certainly did occur on occasion, it was usually out of desperation and an exception to the normal state of affairs. In fact, as far as the evidence goes, so long as there has been trading, there have been rules governing it, and there has been something operating as currency. It may not have been actual coins, but it certainly was currency.

Of course, there was not always trade. Aside from war and other conflicts, some societies simply had no need or even desire for trade. But, as we will see, the idea of everyday people bartering goods and services to others as a staple of society may never have been a thing.

The Problem of Barter Economics

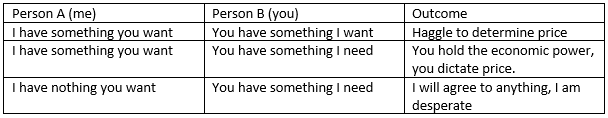

At its root, barter economics has a fundamental problem. Uneven exchange. It works kind of like this:

In this system, there is essentially no such thing as a “fair'” trade, there might be an agreeable trade, but someone is always losing. It’s fairly obviously a terrible system, but humanity is quite fond of terrible systems and we’ve held onto many for a long time, but why is this one so terrible. Well, consider this scenario, I require food to eat, perhaps there was a bad harvest, it’s out of season, or animals have migrated. If I have nothing else with which to trade then my survival is now dependent on one of two things, charity or going into debt to someone who has enough food to feed me. Alternatively, perhaps there was a good harvest, but I am a craftsman, I don’t do farming or don’t have time to make a year’s worth of food. In this scenario, the people who manage the food have something I need but I only produce things they want, and they have the ability to hoard their food in order to make me desperate. Within a very short space of time, the “barter” system is now a debt repayment system, and I am paying it off through slavery.

Through this reasoning, we can clearly see that debt repayment, not barter, would be the basis of such an economy. Bartering is simply an aberration from the norm. This is part of the argument made by David Graeber who has found evidence for debt-based economic structures going back over 5,000 years – roughly as long as we’ve had written records, however, while we have evidence of debt, it should be clear that debt is not a very good way for society to progress. If all the power and wealth is concentrated in the hands of a select few, how then do we get the societies of the ancient world? Certainly, many of these societies had slaves and people in poverty, debt or servitude, but clearly not everyone. There must have been some system other than debt at play. Perhaps a combination of religion and charity helped build a society from the ground up, or perhaps some societies simply practised communal sharing of the most vital goods like food. But perhaps instead these societies had something else. Perhaps they had money.

Origins of the Theory of Barter Economics 1

One of the oldest recorded arguments for barter economics is Aristotle. According to Aristotle, the invention of the coin was simply a common-sense solution to a fairly predictable problem. As the world expands, people become more and more dependent upon more and more distant places and barter is simply insufficient for trade. If you want to do trade, he reasons, you need coins. “At first it was simply defined by size and weight, but finally they also added an impressed stamp, to free them from measuring it, since the stamp was put on as a sign of the amount.”2 Later, Roman jurist Paulus argued that once there was a system of barter, but it was inefficient and relied too heavily on luck, so certain materials were chosen, given a fixed value, stamped and verified by the state, so that “…no longer are both items called commodities, but rather one of them is called commodity and the other called the price.”3

These ideas would later be taken on board by economists and philosophers alike. Adam Smith, the father of modern economics, who – among others of his generation – would go on to describe bartering as a system of “haggling”, “swapping” and “dickering”, for which the invention of money was a solution. Later, the philosopher John Stuart Mills complained about how terrible bartering must have been “If a tailor had only coats, and wanted to buy bread or a horse, it would be very troublesome to ascertain how much bread he ought to obtain for a coat, or how many coats he should give for a horse… …a tailor who had nothing but coats might starve before he could find any person having bread to sell who wanted a coat.”4 All of these writers agree that first there was bartering, bartering had problems, and coins were the natural solution.

What this theory does not explain, is why it took human society literally thousands of years “suffering” through barter economics for them to think of an alternative. Assuming that barter economics is in fact as bad as these authors claim, surely human society must have tried other methods at some point? After all, society would already have to be fairly well developed in order to create coins in the first place, and many of these authors believed in the story Herodotus tells on the origin of money is somewhere around 600 to 560 BCE under the reign of Lydian King Alyattes.5 We can only reach the following conclusions, either barter economics was not as bad as we have so far seen, and coinage was not an overnight revolution – or it was an overnight revolution, and for thousands of years before that either nobody tried to come up with an alternative system, or barter economics was simply the superior system. One way or another each of these authors has fallen victim to inventionist fallacy. The presumption that before one modern contrivance or another was invented, the function that it now performs was not performed at all. To quote author David Schaps: “Many inventions, however, facilitate what had been difficult rather than making possible what had been impossible.”6 What many of these earlier authors didn’t realise was that the evidence had been staring them in the face the entire time.

Cowrie Shells and the “Useless” as Money

In 1945 Wilhelm Gerloff put forward a new theory. The earliest money, he claimed, was not one of useful items, but the exact opposite. Useless items.7 He argued that many useless items like cowrie shells or broken objects and many other items the users might consider useless could be born again as an early form of currency. In the case of broken objects, some objects like a broken knife had an intrinsic value in the weight of its metal, making it an ideal basis for a currency. Useless items on the other hand had value in that they lacked intrinsic value, meaning they were desired precisely because of their lack of alternative function – similar to how we use paper money today.8 Just like today, both systems could run simultaneously. However, unlike the theories and thought experiments of his predecessors, Gerloff had substantial evidence to support his claims.

Right up until the late 1800s, shells were used all over the world as a form of currency. Although often confused as jewellery, we now have considerable evidence for its use in pre-coin economies for more than 4,000 years. In the Indo-Pacific regions of Asia, Africa and Australia, cowrie shells were used, and in some places (Papua New Guinea and the Solomon Islands) is still in to this day. In America the wampum was the most common example, being in use for at least 3,000 years along the east coast, and it was used effectively as both coin and the basis of a writing system.9 In both cases, shells were used concurrently with coins and other forms of legal tender. According to Samuel Smith writing in 1765, wampum shells were even considered legal currency in New Jersey and Delaware, trading at a rate of six white shells or three black shells for one penny.10 There is even evidence for counterfeiting. In New Jersey white shells were often dyed black to artificially increase their value, meanwhile in China cowry imitations carved out of bone have been found dating back at least 4,000 years.11 This is strong evidence that the concepts of a monetary (although not a coin) economy has been with humanity for a very, very long time, but it’s also not the only system we have on record. Other systems have been discovered from an early society that may date back farther than written records allow.

Food as Money

In ancient Egypt, grain was often used as a form of payment. Unlike other resources, grain could be easily accumulated, could be stored for a reasonably long time (about 8 years if kept dry), but due to its expiration it only really had value if it was used or spent. At the same time, the sheer volume of grain produced by any given community meant almost by necessity that it had to be collected, stored and distributed. Without money, only three economic systems would have allowed society to survive. Charity from the elite, communal ownership, or currency. Egypt chose the latter.

Grain and other food products (such as flax wares or beer) quickly became a system of wages and a recognised commodity of set value that workers could then trade with each other.12 This system remained in use for thousands of years and a considerable portion of Egyptian papyri discuss the grain ration. As more luxurious goods proliferated downwards through society other forms of currency became dominant in everyday life, in particular precious metals. As Schaps writes: “Trade was developed in ancient Egypt far beyond anything that Mill would have imagined possible… …everything can be valued according to a single standard, that items have a regular price, and the use of precious metals as standard.”13

Ingots, Copper and “Imaginary” Currency

Before coins, metals were things worth trading and worth trading for. Gold and silver are of course the most famous precious metals to be used as a trading currency, but these materials were simply too valuable for everyday trade – only governments or the elite could deal in such “useless but pretty” metals. But metal still had a valuable place in the economy. Unlike shells, metals have intrinsic value no matter what state it’s in. Unlike jewels, they can be easily divided with minimal loss in value. Unlike foods, they are not perishable and don’t fluctuate wildly in value from year to year.

As early as the third millennium, we find written evidence in royal edicts that copper is the standard to which all other products are compared, with all products having a value compared to copper. Thus someone wishing to trade bread for a cloak could determine how much bread it was worth by comparing the value of the bread and the coat to their respective values in copper. In this way, a worker might be physically paid in a mix of barley, wool and other products, but the value of what they were paid was a fixed amount, measured by their combined value against a copper standard. Other metals such as silver or gold could also be used, but it is clear from the records that even when copper was not physically available, it was still the standard of day-to-day exchange.

This concept of imaginary currency is not uncommon throughout history. In fact for much of the early medieval period, the Carolingian solidi were nothing more than a hypothetical unit of currency – sort of like measuring your wealth in $100,000 bills instead of $1 bills. However, copper may not always have been so unavailable. According to a theory by Neiburger and Spohn, many of the thousands of copper offcuts that have been found on ancient sites across America and Europe may have served the same effective function as coin-currency on a daily basis. As the value of copper would have been measured in weight, then even unworked copper offcuts and broken pieces could be traded by relying on their intrinsic value.14 If that was the case, then even the lowest members of society could trade using the currency of the day, all they needed was a small and otherwise useless piece of it. If correct, then Neiburger and Spohn can date the practice of copper as currency back potentially as far back as 7,500 BCE in North America, a period of more than 9,500 years. Although this theory is tenuous, this suggests that human society has been operating with a monetary-based economy for almost 10,000 years.

Conclusion

Although stamped coins may not have existed, in a very real way the system in which we use coins has been in practice for millennia. Certainly, currency has been part of society since the advent of writing, and certainly debt has been around just as long if not longer. What is clear is that as far as recorded history goes, barter economy as the standard for trade and day-to-day life were never, if ever, a regular thing. Though exceptions certainly could exist, the prevailing evidence suggests that barter was an example of aberration from the norm, existing only in instances of extreme poverty, first contact, or when other economic structures were insufficient for the task.

1 For more on this, see Humphrey C, Hugh-Jones, S., (1992). Barter, exchange, and value : an anthropological approach. Cambridge University Press; and Shcaps, D., (2004) Invention of Coinage and Monetization of Ancient Greece. University of Michigan

2 Arist. Pol. I:9.7-8

3 Digest 18.1.1

4 Mill, book 3, Chap.7:1

5 Herodotus, Histories. I:94

6 Phrase coined by Schaps, D., (2004) Invention of Coinage and Monetization of Ancient Greece. University of Michigan, 8

7 Wilhelm, G., (1947). Die Enstehung des Geldes und die Anf¨ ange des Geldwesens.3

Vittorio Klostermann

9 A condensed explanation can be found in Schaps, D., (2004) Invention of Coinage and Monetization of Ancient Greece. University of Michigan, 10

9 Graeber, D., (2001). Toward an Anthropological Theory of Value: The False Coin of Our Own Dreams. Palgrave

10 Smith, S., (1765). The History of New Jersey. 76

11 Shcaps, D., (2004) Invention of Coinage and Monetization of Ancient Greece. University of Michigan, 11

12 Cerny, Community of Workmen, 236 (DM 141, 1–2)

13 Schaps, D., (2004) Invention of Coinage and Monetization of Ancient Greece. University of Michigan, 41

14 Neiburger, E., Spohn, D. (2007). Prehistoric money. Central States Archaeological Journal. 54 (4): 188–194